technology

technology

[ad_1]

We now stand at the threshold of another era of upheaval. Cash is on the way out, and the digital technologies that are replacing it could transform the very nature and capabilities of money. Today, central-bank money serves at once as a unit of account, a medium of exchange, and a store of value. But digital technologies could lead those functions to separate as certain forms of private digital money, including some cryptocurrencies, gain traction. That shift could weaken the dominance of central-bank money and set off another wave of currency competition, one that could have lasting consequences for many countries—particularly those with smaller economies.

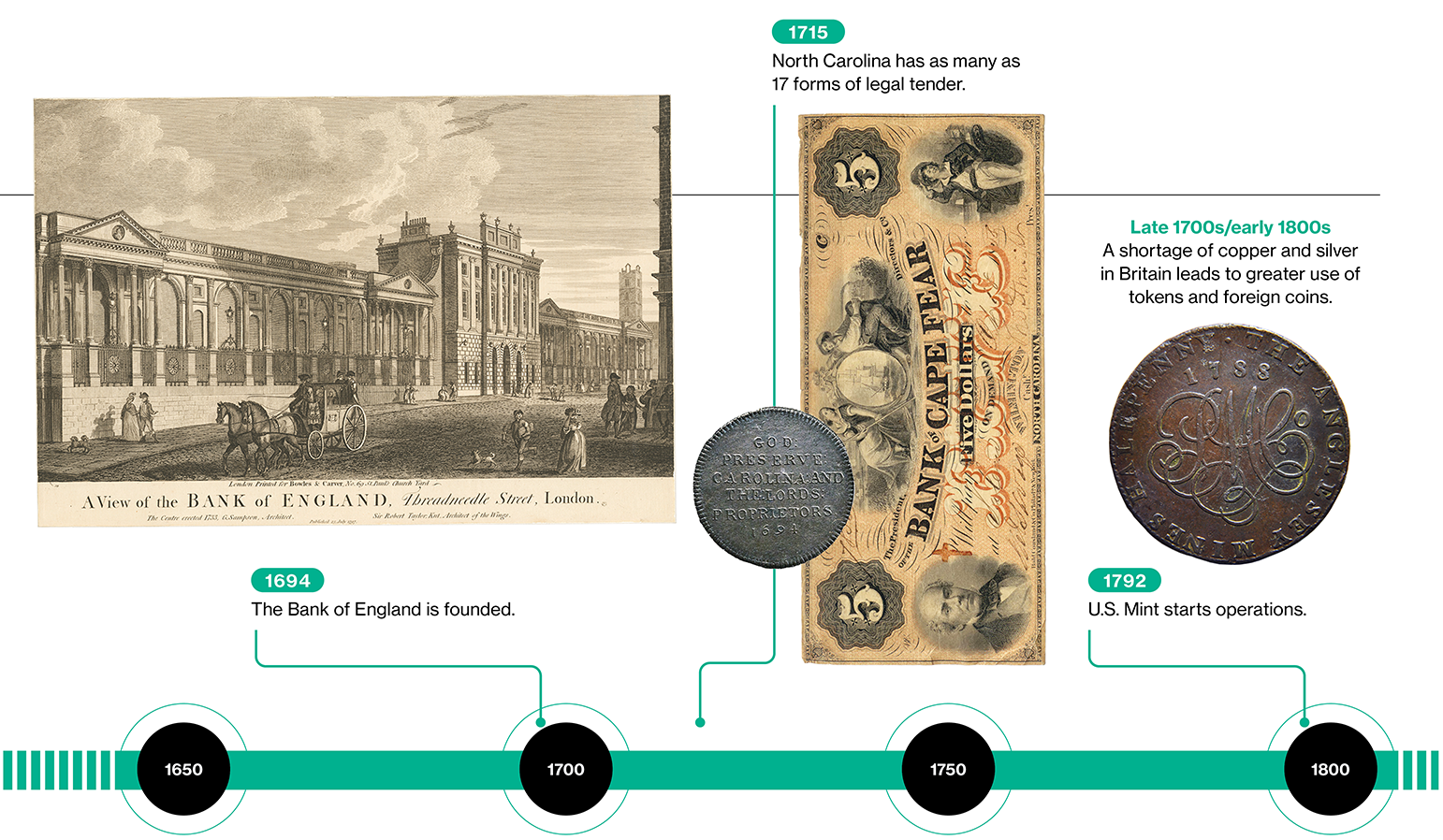

In ancient societies, objects such asshells, beads, and stones served as money. The first paper currency appeared in China in the seventh century, in the form of certificates of deposit issued by reputable merchants, who backed the notes’ value with stores of commodities or precious metals. In the 13th century, Kublai Khan introduced the world’s first unbacked paper currency. His kingdom’s bills had value simply because Kublai decreed that everyone in his domain had to accept them for payment on pain of death.

Kublai’s successors were less disciplined than he was in controlling the release of paper currency. Subsequent governments in China and elsewhere gave in to the temptation of printing money recklessly to finance government expenditures. Such wantonness typically leads to surges of inflation or even hyperinflation, which in effect amounts to a precipitous fall in the quantity of goods and services that a given sum of money can buy. This principle is relevant even in modern times. Today, it is trust in a central bank that ensures the widespread acceptance of its notes, but this trust must be maintained through disciplined government policies.

NEW YORK PUBLIC LIBRARY DIGITAL COLLECTIONS; PUBLIC DOMAIN; JEAN-MICHEL MOULLEC FROM VERN SUR SEICHE, (35, BRETAGNE), FRANCE/WIKIMEDIA COMMONS

To many, however, cash now seems largely anachronistic. Literally handling physical money has become less and less common as our smartphones allow us to make payments easily. The way in which people in wealthy countries like the United States and Sweden, as well as inhabitants of poorer countries like India and Kenya, pay for even basic purchases has changed in just a few years. This shift may look like a potential driver of inequality: if cash disappears, one imagines, that could disenfranchise the elderly, the poor, and others at a technological disadvantage. In practice, though, cell phones are nearly at saturation in many countries. And digital money, if implemented correctly, could be a big force of financial inclusion for households with little access to formal banking systems.

Cash still has some life in it. During the covid pandemic, even as contactless payments became more prevalent, the demand for cash surged in major economies including the US, presumably because people viewed it as a safe form of savings. Many states in the US have laws in place to make sure that cash is accepted as a form of payment, something that would protect people who cannot or do not want to pay through other means. But consumers, businesses, and governments have generally welcomed the shift to digital forms of payment, especially as new technologies have made them cheaper and more convenient.